Anne-Marie Saint-John, Alva, Long Island City, NY >

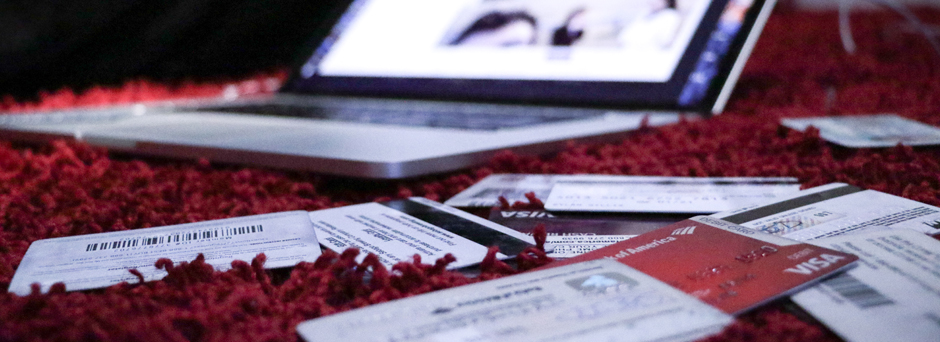

How to Improve your Credit Score

Have you ever applied for a loan and wondered if you received the interest rate you deserve? Your question is valid, as it is very important to know how a lender determines the interest rates it charges. Included in every credit report is the credit score, which lenders use to predict how a person will repay a future loan or credit card.

By understanding the five main factors that affect your credit score, you can work to improve your score and prepare for a better financial future.

#1 – Payment history: More than a third of your credit score is determined by your recent payment history. Several recent late payments can be worse than a bankruptcy that occurred several years ago.

#2 – Amounts You Owe: Do you have credit available for emergencies? The credit bureaus want to be sure that your balance is not too close to your limit. A balance of more than 35% of a credit card limit can negatively affect your score.

#3 – Length of your Credit History: Demonstrating responsibility through the past few years helps raise your credit score. Never cancel a card that you have had for several years.

#4 – Types of Credit Used: When you are ready, apply for the credit you need. There are two types: term and revolving loans. Mortgages, car loans, and student loans are considered term loans (credits). To diversify your history a bit, you can also apply for a credit card, which is considered a revolving loan.

#5 – Many Applications: Your credit history will be investigated every time you apply for any form of credit. It is very important that you do not apply frequently, as these inquiries will lower your credit score.

Generally, your personal information or certain financial obligations do not affect your credit score. US law prohibits credit institutions from considering your race, color, origin, sex, religion, or marital status. At the same time, factors such as child/family support or rental agreements are also not included in calculating your score. However, a lender may consider your age, place of residence, and your employment information (such as your salary) when processing your application.

Your credit score considers both positive and negative information on your report. By working with the five factors outlined in this article, you can help your credit score go up.

Practical Tip: Work on what you can control. Paying your bills on time and keeping your balances low are two important factors in calculating your credit score.