Impact

Shifted from just access to capital to include improved financial health to increase our positive impact on clients

Small businesses served nationwide

Jobs created and saved

Loan capital deployed

Hours of direct counseling to 1,156 individuals

The shift to financial health reflected our understanding that financial inclusion was no longer enough.

More than ever, our clients needed to be financially healthy: resilient and able to access opportunities over time.

To measure this, we spearheaded a new impact measurement framework to longitudinally measure clients' progression across credit and cash flow, and will implement this in 2023.

Created a new impact framework focused on financial health

Financial health measures the ability to access opportunity and be resilient over time, and is grounded in growing credit and cashflow, and financial health indicators.

Innovation

Innovated new offers to address new challenges

The Get Ready Program: Developed better credit outcomes for Black entrepreneurs

Rideshare Loan: Provided a financial lifeline and security

$1.4MM to 105 rideshare drivers - 100% entrepreneurs of color

“It makes a world of difference to have someone believe in you.

Ascendus gave me resources, helped me build credit, and helped me prove that I could pay back a loan.”

Line of Credit: Our first revolving capital product

$1.3MM to 115 small business owners - 100% entrepreneurs of color

Reducing declination rates by 40% through the launch of a smart new scorecard

Inclusion

Increased inclusion for those most affected by the pandemic

Entrepreneurs

of Color

Low-to-Moderate-

Income Clients

We Served

“When the pandemic started and we lost the majority of our clients we didn't qualify for grants or loans as we were very small.

Ascendus believed in us and gave us a loan for us to invest in our company and help us pivot our business to launch three new products.”

Creating in-house loan funds

for clients locked out of

COVID-19 support

$2.4MM to 112 small business owners through support from the CDFI Rapid Response Program and the state of Massachusetts

“Capital access remains the most important factor limiting the establishment, expansion, and growth of minority-owned business.”

-U.S. Chamber of Commerce

In Black or Hispanic communities, most small businesses had fewer than 14 days cash buffer days on-hand

31%

Only 31% of small businesses who applied for capital in 2021 received what they needed

40%

40% of Black and 30% of Hispanic households are unbanked or underserved compared to just 12% of white households

GROWTH

Grew the organization through collaboration, inclusion, and innovation

$0

2019

$0

2020*

$0

2021*

$0

2022

Deployed 2.5 times the annual capital deployed before COVID-19

*Includes $5.9 million and $26.3 million in PPP lending in 2020 and 2021, respectively

“We are so grateful to Ascendus.

We hope to continue giving back as much as we can because of the help we have received.”

$25.6MM to 388 small

business owners

through regional Special

Purpose Vehicle Programs

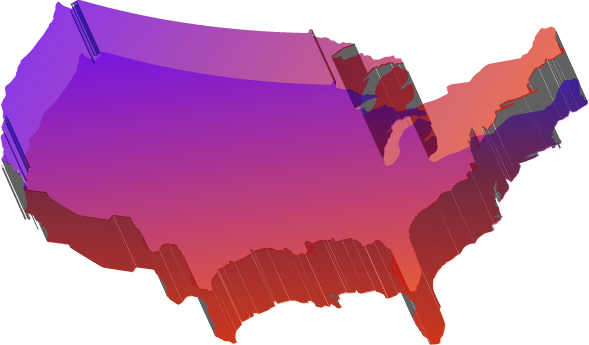

Growth Through Collaboration: Designed and participated in regional Special Purpose Vehicle Programs. Grew our reach in the South and Pacific Northwest through programs such as The Southern Opportunity and Resilience Fund (SOAR), The Washington Flex Fund, and The Connecticut Small Business Boost Fund

$30.4MM and 981 loans to Black, Hispanic, or women small business owners

Growth Through Inclusion: Industry focus on childcare and restaurants through in-house loan funds.

$2MM and 155 loans through new programs

Growth Through Innovation: Created new programs like the Line of Credit and Rideshare Programs.

We hired and grew our team by 30%

We expanded to new geographies, and added new roles.

FINANCIALS

Total net assets

Expenses attributed to program services

Delinquency rate

(excluding PPP loans, 30 DPD)

$23.6MM

2021

$59.7MM

2022

52%

Total portfolio serviced

(before participations)

Thank You

Your support creates financial health for small business owners and jobs and services for their communities

| Institutional Donors | Individual Donors |

| Apple Bank | Adam Grenier |

| Bank of America Charitable Foundation | Alan Cody and Edith Moricz |

| Bank United | Amy Hellen |

| Berman Aries Family Charitable Fund | Andrew Epstein |

| Boston Beer Company | Anonymous |

| Cambridge Savings Bank | Aurelina Romero |

| Capital One Bank | Barbara Romani |

| Clark Foundation | Cheryl Myers and Steve Stockton* |

| Community Development Financial Institutions Fund | Clara Diaz-Leal |

| Dime Community Bank | Colleen Galvin* |

| Eastern Bank Charitable Foundation | Cristina Shapiro* |

| Empire State Development | Daniel Delehanty* |

| Goldman Sachs & Co. | Diana Waterbury |

| HAB Bank | Tyler Van Gundy |

| HSBC Bank USA | Fabiana Estrada |

| Hyde & Watson Foundation | Fazeela and Shameer Yasin |

| Investors Bank Charitable Foundation | Gina Scime |

| JP Morgan Chase Foundation | JJ Singh |

| Lawrence Foundation | Jeanne Celestin |

| Massachusetts Growth Capital Corporation | Jerry and B Lynn Crane |

| MetLife Foundation | Jerome Weiss* |

| Miami Foundation | Jerry and B Lynn Crane |

| Mizuho USA Foundation | Jessica Daniels and Paul Blackborow |

| Morgan Stanley | Joel Abrams |

| Moses Kimball Fund | Joseph Hernandez |

| New York City Council | Kimberly Johnson |

| Paul and Edith Babson Foundation | Laura Miller* |

| People's United Bank | Leo Toca |

| Point23Health Foundation | Lisa Servon |

| Popular Foundation | Lynn Patinkin |

| Revolve Asset Management | Mario Dore-Bernhard |

| Roy A. Hunt Foundation | Marsha Tucker |

| Santander Bank | Matthew Zlatnik |

| Schwab Charitable Fund | Max Myers and Victoria Richardson* |

| Signature Bank | Michael and Anne Marie Mlecko |

| Silicon Valley Bank | Michael Carnahan |

| State Stox New York | Mihai Vrasmasu |

| Sterling National Bank | Myrna Sonora |

| TD Bank | Nancy Atherton* |

| TD Charitable Foundation | Pablo Cortina |

| TIAA Bank | Patrick Peterson and Shirley Tsai |

| US Small Business Administration | Paul and Marieta Quintero* |

| Valley Bank | Paul Dominguez* |

| Vidda Foundation | Paul Hunt* |

| Wells Fargo Foundation | Perri Richmond* |

| William and Patricia Robbins Charitable Fund | Richard Clarke* |

| Wilmington Trust | Rodrigo Cerveira |

| Roshelle Nagar* | |

| Selina Yasin | |

| Sherry and David Cook* | |

| Shirley and Timothy Blancke | |

| Stephen Cassell | |

| Steven Dinanno | |

| Sudhir Jain | |

| Sulondia Hammond | |

| Suzanne and Paul Lipsky | |

| Todd Flolo* | |

| Victor Rodriguez | |

| William Burrus | |

| Zara Ingilizian |

*Thank you to our recurring donors.

About Us

We believe in the Power of Up

Ascendus envisions a world of financial ascension for all. Our organization empowers low- to moderate-income (LMI) business owners with access to capital and financial education. With money and advice, small business owners have better access to opportunity, are more resilient in the face of adversity, and create opportunity for their employees, families, and the community. This Way Up!

4 Star Charity

CDFI Fund’s Financial Assistance (FA) Award