VISIONS & VALUES

letter from the CEO

and Chair

If art imitates life, then the words of Charles Dickens reflect today’s times when he wrote, “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.”

Throughout the pandemic, Ascendus strived to protect its staff, clients, and organization as we navigated the once-in-a-century pandemic. Our 2021 results show that we served more small business owners with more capital than at any time in our storied history. We achieved these record-breaking results because of the financial support of our partners like you, the dedication of our staff and board members, and the one-time events of federal, state, and local grant-making programs. We remained focused on the mission and energized by a vision that seeks to create a world of financial ascension (and not merely inclusion) for all.

Operationally, we achieved a stellar year because of our focus on agility, collaboration, and innovation for impact. For example, in 2021, we launched two special purpose vehicle (SPV) programs that serve sixteen (16) states within eight (8) weeks of one another. The inspiration for these programs was the innovation created through The New York Forward Loan Fund that we launched in 2020. Importantly, these efforts all required the collaboration of multiple parties, including other Community Development Financial Institutions (CDFIs) such as Ascendus. On the innovation side, Ascendus launched its first working capital line of credit offer to support small business owners’ short-term, seasonal, and non-capital needs. We are one of the few organizations to offer such a product in the industry.

In 2022, we renewed and expanded our leadership. Laura Miller and Colleen Galvin assumed their roles as our new board chair and vice-chair, respectively, at the fiduciary board level.

Strategically, we will reposition Ascendus from relief to recovery efforts in 2022. We will start by increasing the number of eligible applicants by modernizing our credit risk scorecard. Then, we will introduce new financial products and services uniquely designed for our target audience. Finally, we will establish a monitoring system that will track our clients’ credit, cash flow, and financial health to measure their advancement toward financial health.

At Ascendus, we believe in the power of “UP,” which means we understand that growing a business is a way to improve life, care for family, and contribute to the community. With your support, we will strive to ensure our clients continue to experience “the best of times.”

Paul Quintero, CEO |

Laura Miller, Board Chair |

we believe in the

power of up.

Mission

Ascendus empowers low- to moderate-income small business owners with access to capital and financial education.

About

Ascendus believes in the bold vision of creating financial ascension for those who have been systemically excluded from financial opportunity. For over 30 years, we’ve provided small business owners – primarily minorities, women, and immigrants with the tools to move up, improve their lives, care for their families, and contribute to their communities.

a focus on vision and values

We are guided by our vision of “creating financial ascension for all,” achieved by serving certain people in specific places that need us most. We are inspired by our lived values of adaptability, dedication, empathy, inclusion, integrity, and passion.

INNOVATION FOR IMPACT

We led our industry in pioneering innovative relief and recovery efforts.

innovating for impact

We focused on business survival, and estimate that almost 94% of Ascendus businesses remain in healthy operations despite the historic challenges posed by the COVID-19 pandemic

We focused on job retention, and provided employment for over 960 individuals

We doubled our 2020 lending, and tripled our 2019 lending, allowing more resources to be disbursed in under-resourced communities than ever before in our history

Our impact in communities of color rose as entrepreneurs of color received lending at 16% higher than 2020

innovation for ascension

ACCESS TO CAPITAL

Ascendus provides small business owners with the innovative capital they need to start, stabilize, or expand their business and build their credit.

TECHNICAL ASSISTANCE

Each client is paired with a dedicated loan consultant, from whom they receive one-on-one counseling to keep their business open and thriving.

SUPPORT SYSTEMS

Clients have access to networks of support that provide them tools to grow businesses, create jobs, and provide for their household and communities.

FINANCIAL ASCENSION

With access to capital and financial education, Ascendus clients build financial resiliency and unlock access to financial opportunity for their families.

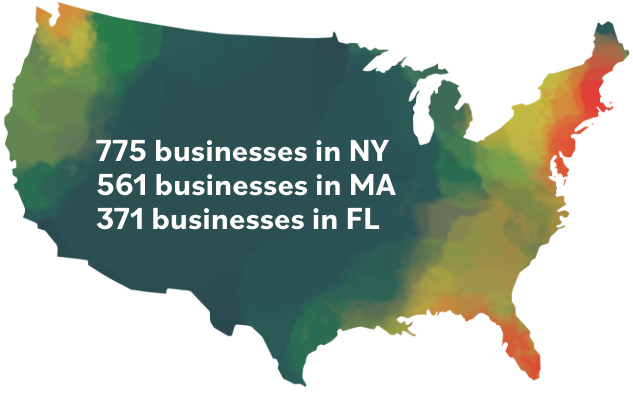

a focus on who we serve

Our strategic focus on providing access to capital, financial education, and economic opportunity allowed us to meet the needs within our affinity groups and core geographies.

24 total states served

64% low- to moderate-income households

53% immigrants

73% entrepreneurs of color

60% Black or Latinx entrepreneurs

41% women

INNOVATION

Creating Stability with New Credit Solutions

In October, we introduced our first ever revolving loan product – a Line of Credit – created for businesses that need flexibility on borrowing and repayment schedules, like restaurants, seasonal businesses, and more. As of June 2022, we have delivered $675,000 to 56 small businesses in NYC.

“The (RFLF) loan allowed me to open back up my café. Working with Ascendus made me feel secure.”

– Kymme Williams-Davis, Bushwick Grind Café

INNOVATION

Creating Workplace Equity for Restaurant Sector

Created in partnership with the Restaurant Workers Community Foundation, we delivered $775,000 in zero interest loans to 19 small businesses through the Restaurant Futures Loan Fund. These loans build businesses and engineer equitable conditions for employees of our clients.

AGILITY

We remained nimble, bringing transformative change to the communities who most need our help

addressing the need

ACCESS TO CREDIT

54% of Black and 41% of Latinx individuals have low to no credit scores, compared to 37% of their white counterparts – impacting their ability to access credit.

ACCESS TO CAPITAL

Only 26% of Black business owners and 32% of Latinx business owners receive the full amount of financing sought, compared to 54% for their white counterparts – impacting their ability to launch and grow.

ACCESS TO COACHING

92% of small business owners say mentorship is invaluable to small business success, however less than 40% of Black owned businesses and less than 34% of Latinx owned businesses have access to mentorship – impacting their financial health and ability to stay open.

The number of small businesses we supported, nationwide

The amount of loan capital we disbursed to 2,138 individuals – going above and beyond all previous records of service

The number of hours of direct counseling in areas of business credit, managing cashflow, how to manage debt, and much more

The number of businesses we reached through 31 workshops conducted nationwide, on topics related to financial normalization, pandemic relief products, business financing, and more

“When COVID-19 hit we were petrified. Working with Ascendus was a godsend. No one else took the time to explain to me what I was getting and what I would get back. I could call at any time, any day, and they would call back.”

– Marquita Kelly, NHK Electrical Contractors

AGILITY

CDFI Rapid Response Program Provided Opportunities to Those Affected by COVID-19

We were awarded a prestigious $1.8 million grant to support economic relief in communities affected by COVID-19 from the U.S. Department of Treasury’s Community Development Financial Institutions Rapid Response Program because of our capacity and ability to get funds to struggling small businesses. Through the fund, we quickly deployed $800,000 to 116 small businesses in 2021 and disbursed the balance in 2022.

AGILITY

Deploying $33 Million During a Pandemic – $14,000 At a Time

Through the Paycheck Protection Program, we provided $33 million and 2,300 loans – including $26 million deployed in 2021 alone. With an average loan size of just $14,000, over 70% of clients were sole proprietors and 70% were entrepreneurs of color. Of those loans, 93% have already been fully forgiven by the SBA.

“Ascendus was my lifesaver.They took my dream and helped me elevate it and make it bigger. I used the (PPP) money to design, develop and launch a ridesharing app.”

– John Sosa, CT App

“Receiving a SOAR loan from Ascendus was a game changer for our story.”

– Javier Zamora, SushiKong

AGILITY

Collaborating With Mission Lenders to Bring Relief to the South

Modeled after the New York Forward Loan Program, the Southern Opportunity and Resilience Fund brought together 15 mission lenders and industry leaders to provide COVID-19 Relief in the South. One of the most prolific lenders through the program, we disbursed $3.1 million to 79 small businesses through the program.

“I came to this country not wanting anything from anyone, just a chance to make it. Ascendus helped me do that.”

– Sayblee Darsale at Sayblee Products

COLLABORATION

The ‘Us’ in Ascendus: We worked with our partners to serve more clients than ever before in our history.

COLLABORATION

Creating the First Multi-Party COVID-19 Relief Program – The New York Forward Loan Fund

The country’s first COVID-19 Relief SPV Program to launch, we worked with public and private partners, as well as four other CDFIs, to deliver the blueprint of capital relief for small businesses. We provided $6.1 million to 161 New York small businesses in 2021, and replicated its success in seventeen other states, including the Southeast, California, and Washington.

“I was struggling, I still had to pay rent when the daycare was closed. The (NYFLF) loan helped me to pay the rent, pay my employees, and more.”

– Claudia Gaviria,

Creative Little Hands Daycare

“Receiving the Small Business Flex Fund from Ascendus was like a beacon in the storm.”

– Alisha Weiss, Skyhawk

COLLABORATION

Providing Flexibility Through the Small Business Flex Fund

Created in collaboration with the Washington State Department of Commerce, the Small Business Flex fund allows for competitive interest rates and flexibility on spending. We grew our footprint in the Pacific Northwest and delivered $2.3 million to 33 small businesses through the Small Business Flex Fund.

COLLABORATION

Wells Fargo’s Open for Business Program Creates Agile Lending Model

Through support from Wells Fargo, we quickly stood up a relief program for small businesses in Massachusetts when there were no other loan relief programs available in the state. We delivered $1.7 million to 74 entrepreneurs through the Open for Business Program, 100% of whom were entrepreneurs of color.

“Ascendus approved a (OFB) loan to help us keep investing in our business and increasing our portfolio. Because of this we were able to rebrand and launch 3 new products.”

– Juan Arroyave,

Kikos Coffee and Tea

recognition of our work

4 Star Charity

Guidestar Platinum Seal

CDFI Fund’s Financial Assistance (FA) Award

SBA South Florida District Office Mission Based Lender Award

SBA Microlender of the Year Award in MA

With your support and collaboration, we can provide the resources needed to help our clients on the road toward financial ascension. These resources were especially important during the COVID-19 pandemic and continue to be necessary during the recovery. Thank you for supporting small business owners and their communities.

thank you to our 2021 Ascendus supporters

Institutional Partners

Amazon

Amerant Bank

Bank Leumi

Bank of America Charitable Foundation

Bank United

Berman Aries Family Charitable Fund

Boston Private Bank and Trust Company

Brooklyn Community Foundation

Cambridge Savings Bank

Capital One Bank

Comerica Charitable Foundation

Community Development Financial Institutions Fund

Community Reinvestment Fund

Community Wealth Partners

Dime Community Bank

Eastern Bank Foundation

Empire State Development

Fidelity Charitable Gift Fund

FJCA Foundation of Philanthropic Funds

Friedman Family Foundation

Goldman Sachs

HAB Bank

Healthfirst

HSBC Bank USA

Hyde & Watson Foundation

Investors Bank Charitable Foundation

Lawrence Foundation

Margaret E. Senturia Fund

Massachusetts Growth Capital Corporation

MasterCard

Metropolitan Commercial Bank

Miami Foundation

Morgan Stanley

Moses Kimball Fund

MUFG Foundation

NYC Department of Small Business Services

Opportunity Finance Network

Paul and Edith Babson Foundation

PepsiCo Foundation

Rita J. & Stanley H. Kaplan Family Foundation

Robin Hood Foundation

Santander Bank

Sterling National Bank

TD Bank

TD Charitable Foundation

The Boston Beer Company

The Clark Foundation

The Coca Cola Company

The Community Foundation for Northeast Florida

The JPMorgan Chase Foundation

The Mizuho USA Foundation

TIAA Bank

US Small Business Administration

Ventress Family Foundation

Wells Fargo Foundation

Individual Donors

Alan Branfman

Alan Cody and Edith Moricz

Amy Hellen

Andrew Epstein

Andrew Ziolkowski

Anna Dodson

Anne Fish

Anne Lynes

Anonymous

Ashley Wessier and Sherri Lane

Cheryl Myers*

Clara Diaz-Leal

Colleen Galvin*

Cristina Shapiro*

Daniel Delehanty*

Diana Waterbury

Eddie Mamiye

Edward Van Gundy

Elise Tosun

Fabiana Estrada

Fazeela and Shameer Yasin*

Henrik Totterman

Henry, Catherine, and Will Lanier

Jas Singh

Jerome Weiss

Jessica Daniels and Paul Blackborow

Jonathan Bello

Julia and Harold Bordwin

Kathleen McQuown*

Kimberly Johnson

Laura Miller*

Leo Toca

Lisa Servon

Luke Taylor

Man Chung Yung

Marsha Tucker

Matthew Zlatnik

Max Myers and Victoria Richardson*

Michael and Claudine Henry

Mihai Vrasmasu

Myrna Sonora

Nancy Atherton*

Patrick McEvoy

Paul and Marieta Quintero*

Paul Dominguez*

Paul Hunt*

Rachael Deutsch

Regina Goldstein

Richard Clarke

Richard Thompson

Rodrigo Cerveira

Roshelle Nagar

Russell and Linda Gee

Sherry and David Cook*

Shirley and Timothy Blancke

Stephany Rojo

Stephen Cassell

Sudhir Jain

Suzanne and Paul Lipsky

Thomas and Susana McDermott

Todd Flolo*

William and Sandra Rosenfeld*

Zara Ingilizian

*thank you to our recurring monthly sustaining donors